45l tax credit form

Qualifying properties include apartments. Get 2000 Tax Credit per Home - Learn.

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home

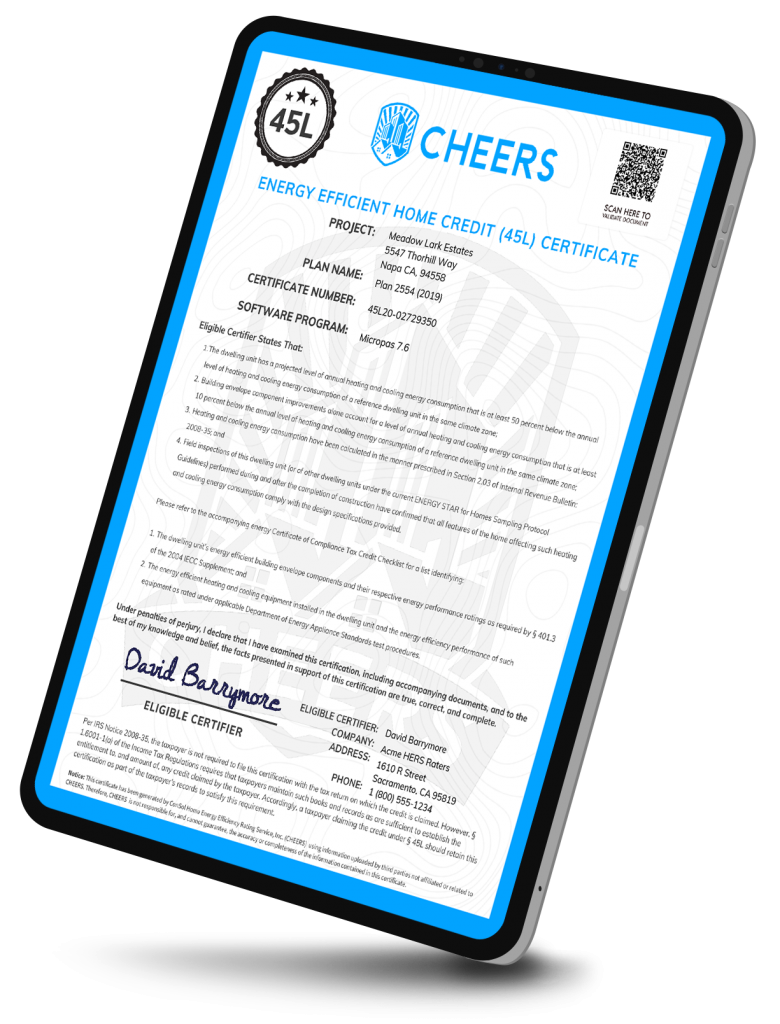

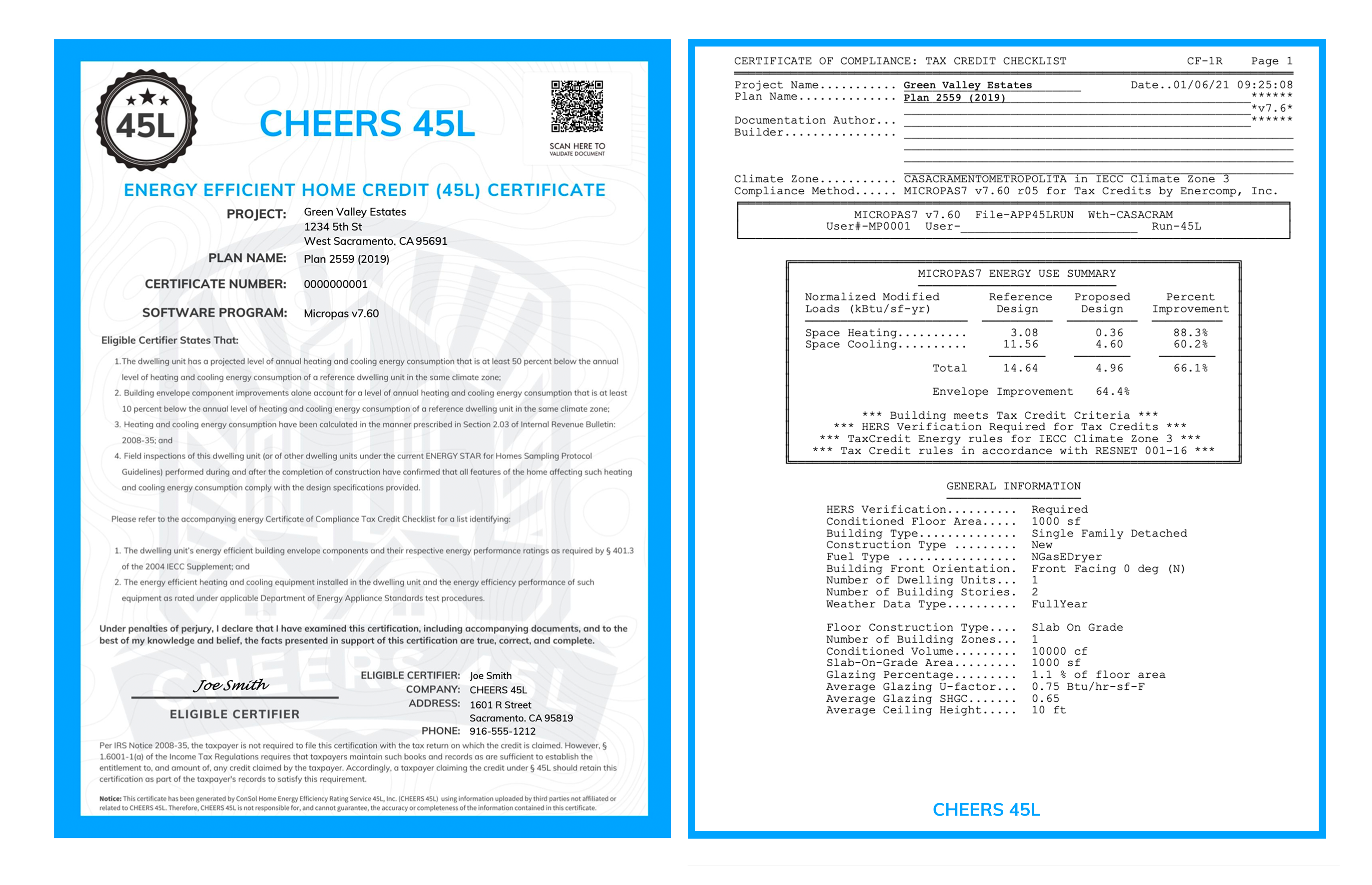

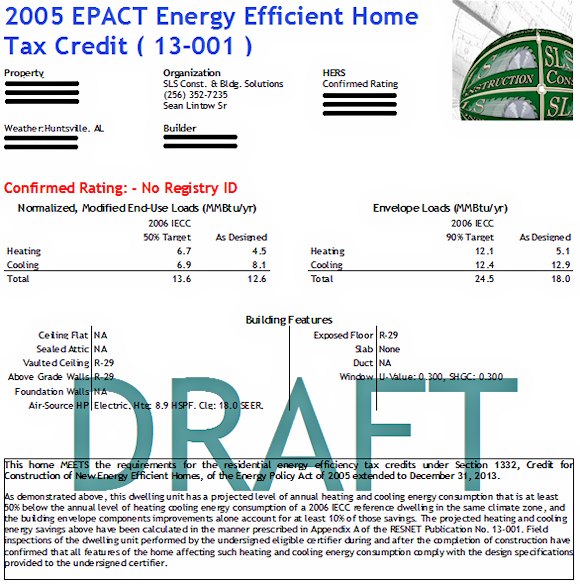

In order to claim the credit a licensed third-party through must conduct on-site testing and energy modeling to produce a certification package.

. What is the 45L Tax Credit. The term 45L comes from the federal statute. The credit is reported on IRS Form 8908 Energy Efficient Home Credit.

45L Tax Credit Form - Tacoma Energy Products and Solutions New Home Construction. The developer would be eligible for 600000 in 45L credits in 2019 and 200000 in 45L credits in 2020. The 45L is a tax credit available to builders and developers who financed the construction of energy efficient homes and then sold or leased them.

The 45L Tax Credit originally. THE 45L ENERGY EFFICIENT HOME CREDIT. The 45L tax credit for energy-efficient homes provides 2000 per unit for owner-occupied or rental dwelling buildings that meet certain qualifications.

2 Form Any certification described in subsection c shall be made in writing in a manner which specifies in readily verifiable fashion the energy efficient building envelope. Based on current construction trends many. Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings.

Energy credit part of the investment tax credit must not again be considered in determining the energy efficient home credit. For qualified new energy efficient homes other than manufactured homes the. The 45L credit is claimed on IRS Form 8908.

Enter total energy efficient home. The 45L tax credit was intended to help buildersproperty owners claim around 2000 in tax credit for each energy-efficient home they construct or sell. I am currently getting the.

Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home. The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home 2000 per qualified home Single family and m ulti-family projects up to. The qualified contractor typically the developer builder or homeowner is the only person who can claim the 45L tax credit and must own the unit at the time of construction or improvement.

The 45L Tax Credit offers 2000 per dwelling unit to developers of energy efficient apartment buildings and homes in the state of Texas. The 45L was established to help and encourage builders manufacturers and developers to construct more energy efficient buildings. The tax credit was retroactively extended from.

Claiming Energy efficient 45L tax credit using 8908 form for a new fourplex construciton I have a new fourplex built and leased in 2019. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is. Currently the 45L Credit allows eligible developers to claim a 2000 tax credit for each newly constructed or substantially reconstructed.

A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed. The 45L tax credit allows taxpayers to claim potentially significant credits for the construction of new energy-efficient homes. We model every new home in the most cost effective energy efficient way.

Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible contractors with a 2000 tax credit for each energy efficient. The 45L Energy-Efficient Home Tax Credit is equal to 2000 per residential unit or dwelling to the developers of energy-efficient buildings.

The Home Builders Energy Efficient Tax Credit An Faq

179d Tax Deductions 45l Tax Credits Source Advisors

What Is The 45l Tax Credit Get 2k Per Dwelling Unit We Can Help

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And Help Paparazzi Consultant Paparazzi Fashion Paparazzi Jewelry Displays

45l Tax Credit What Is The 45l Tax Credit Who Qualifies

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Taxlawyer Or Attorney Is The Title Of A Professional Who Works For His Or Her Client In The Field Of Taxation Today Tax Lawyer Tax Attorney Tax Services

Green Building That Saves You Big Bucks With 45l Tax Credit Benefits Tax Preparation Tax Deductions Income Tax Return

45l Tax Credit Energy Efficient Home Tax Credit Tax Point Advisors

What Is The 45l Tax Credit Get 2k Per Dwelling Unit We Can Help

Dpis Builder Services 45l Energy Efficiency Tax Credit

What Did We Learn From The Paradise Papers Paper Learning Paradise